Example: VAR Model in TSMT

Vector autoregressive models generalize the single variable autoregressive model to allow for more than one endogenous variable. The standard (or reduced) form of a VAR(1) model with two separate time series is:

yt,1 = α1 + φ11 yt-1,1 +φ1,2 yt-1,2 + ut,1

yt,2 = α2 + φ21 yt-1,1 +φ22 yt-1,2 + ut,2

Assuming:

- y is an N by p matrix, where N is the length of the time series and p is the order of the VAR.

- alpha is a 1 by p matrix, representing the intercept term.

- e is an N by p matrix containing the error term.

We can express a VAR(p) model in matrix form, using GAUSS code as:

y[t,1:p] = alpha + y[t-1,.] * phi' + e[t,.];Load and plot time series

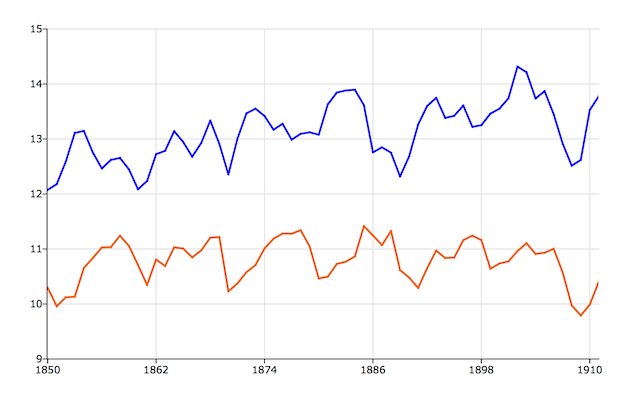

For this example, we will use a data set that comes with TSMT, named minkmt.asc. This file contains data for the prices of two commodities from 1850 to 1910. The first column contains the dates and the second and third columns contain the data.

//Get path to GAUSSHOME directory

path = getGAUSSHome();

//Add file name to path

fname = path $+ "examples/minkmt.asc";

//Load data from the second and third columns

//of a space separated text file

y = csvReadM(fname, 1, 2|3, " ");

//Load first date

first_date = csvReadM(fname, 1|1, 1|1, " ");

//Plot data

plotTS(first_date, 1, y);The above code should produce a plot that looks similar to this:

The first thing that we notice is that the, at least the first series, seems to have a trend and that neither series has a mean near zero. We can use the TSMT function, vmdetrendmt to remove the trend and demean the data. The vmdetrendmt function takes two inputs:

- An NxK matrix containing one or more time series to be acted upon.

- A scalar, indicator variable with the following options:

0 Return the original data untouched. 1 Detrend the data, based upon a linear model. 2+ Detrend the data based upon a polynomial model.

Now we will detrend and demean our data, assuming only a linear trend.

//Load TSMT library functions

library tsmt;

//Detrend and demean data

y_detrend = vmdetrendmt(y, 1);

//Plot transformed data

plotTS(first_date, 1, y_detrend);The graph of the detrended data should look more like this:

After detrending, the data appears to have a mean of zero and does not have a trend. However, the variance of the data seems to increase with time. Let's try differencing the data instead of detrending:

//Calculate the first difference

y_diff = vmdiffmt(y, 1);

//Plot transformed data

plotTS(first_date, 1, y_diff);The plot of the differenced data should look like this:

This plot does not appear to have a trend, the mean is near zero and the variance does not appear to increase with time.

Estimating the Vector Autoregressive Model

The varmaxmt function is a convenient tool for estimating the parameters of VAR models with or without exogenous variables. The varmaxmt function takes two required arguments:- A varmamtControl structure.

- An N x K data vector, y, where each column of y is a different time series.

The varmamtControl Structure

This structure handles the matrices and strings that control the estimation process such as specifying whether to include a constant, output appearance, and estimation parameters. Continuing with the example above,//Declare 'vctl' to be a varmamtControl structure

//and fill with default values

struct varmamtControl vctl;

vctl = varmamtControlCreate();

//Declare 'vout' to be an varmamtOut structure,

//to hold the results from 'varmaxmt'

struct varmamtOut vout;

//Specify the AR order to 2

vctl.ar = 2;

//Specify order of differencing

vctl.diff = 1;

//Specify MA order

vctl.ma = 0;

//No constant in model

vctl.const = 0;//Perform estimation with 'varmaxmt'

//Note that we are passing in the original, 'y'

//Since we told 'varmaxmt' to difference 'y',

//by setting vctl.diff = 1

vout = varmaxmt(vctl, y);===============================================

VARMAX Version 2.1.3

===============================================

Phi

Plane [1,.,.]

-0.12309 0.57672

-0.67611 0.34425

Plane [2,.,.]

0.26190 -0.12894

-0.26000 -0.044378

standard errors

Plane [1,.,.]

1.0000 1.0000

1.0000 1.0000

Plane [2,.,.]

1.0000 1.0000

1.0000 1.0000

t-values

Plane [1,.,.]

-0.12309 0.57672

-0.67611 0.34425

Plane [2,.,.]

0.26190 -0.12894

-0.26000 -0.044378

probabilities

Plane [1,.,.]

0.90253 0.56672

0.50209 0.73210

Plane [2,.,.]

0.79447 0.89792

0.79593 0.96478

Residual Covariance Matrix

0.066376 0.026428

0.026428 0.065819

standard errors

1.0000 1.0000

1.0000 1.0000

t-values

0.066376 0.026428

0.026428 0.065819

probabilities

0.94734 0.97902

0.97902 0.94778

Beta0

-0.010973

0.021210

Augmented Dickey-Fuller UNIT ROOT Test for Y1

Critical Values

ADF Stat 1% 5% 10% 90% 95% 99%

No Intercept -5.2278 -2.5328 -1.9498 -1.6266 0.9152 1.3168 2.1179

Intercept -5.1774 -3.5663 -2.9370 -2.6152 -0.4393 -0.0499 0.6942

Intercept and Time Trend -5.2981 -4.0892 -3.4615 -3.1709 -1.2584 -0.9195 -0.2986

Augmented Dickey-Fuller UNIT ROOT Test for Y2

Critical Values

ADF Stat 1% 5% 10% 90% 95% 99%

No Intercept -4.7720 -2.5328 -1.9498 -1.6266 0.9152 1.3168 2.1179

Intercept -4.7352 -3.5663 -2.9370 -2.6152 -0.4393 -0.0499 0.6942

Intercept and Time Trend -4.6155 -4.0892 -3.4615 -3.1709 -1.2584 -0.9195 -0.2986

Phillips-Perron UNIT ROOT Test for Y1

PPt 1% 5%

No Intercept -7.2621 -2.5328 -1.9498

Intercept -6.9186 -3.5663 -2.9370

Intercept and Time Trend -6.9497 -4.0892 -3.4615

Phillips-Perron UNIT ROOT Test for Y2

PPt 1% 5%

No Intercept -6.3499 -2.5328 -1.9498

Intercept -5.9127 -3.5663 -2.9370

Intercept and Time Trend -5.8505 -4.0892 -3.4615

Augmented Dickey-Fuller COINTEGRATION Test for Y1 Y2

Critical Values

ADF Stat 1% 5% 10% 90% 95% 99%

No Intercept -5.0448 -3.4003 -2.8198 -2.4901 -0.2841 0.1628 0.9912

Intercept -5.0375 -4.0246 -3.4040 -3.0890 -0.9988 -0.6383 0.0929

Intercept and Time Trend -5.1691 -4.5041 -3.9157 -3.6062 -1.6464 -1.3413 -0.6750

Johansen's Trace and Maximum Eigenvalue Statistics. r = # of CI Equations

Critical Values

r Trace Max. Eig 1% 5% 10% 90%

No Intercept 0 65.5906 46.3981

1 19.1925 19.1925 1.0524 1.7046 2.1927 9.3918

Intercept 0 65.6102 46.4140

1 19.1962 19.1962 2.2515 3.3599 4.0975 12.8635

Intercept and Time Trend 0 66.2392 46.3986

1 19.8406 19.8406 4.0389 5.3796 6.1879 16.1762

Dep. Variable(s) : Y1 Y2

No. of Observations : 61 61

Degrees of Freedom : 50 50

Mean of Y : 0.0018 0.0279

Std. Dev. of Y : 0.3014 0.3506

Y Sum of Squares : 5.4509 7.3772

SSE : 4.0489 4.0150

MSE : 0.0730 0.0723

sqrt(MSE) : 0.2701 0.2690

R-Squared : 0.2572 0.4558

Adjusted R-Squared : 0.1086 0.3469

Model Selection (Information) Criteria

......................................

Likelihood Function : -2.0830

Akaike AIC : -17.8339

Schwarz BIC : 49.3857

Likelihood Ratio : 4.1661

Characteristic Equation(s) for Stationarity and Invertibility

AR Roots and Moduli:

Real : 4.2121928 -1.9895302

Imag.: 0.0000000 0.0000000

Mod. : 4.2121928 1.9895302

MULTIVARIATE ACF

LAG01 LAG02 LAG03

0.03143 0.06429 -0.1224 -0.0856 -0.0715 -0.1648

0.002152 -0.03561 -0.1163 -0.2181 0.133 0.1341

LAG04 LAG05 LAG06

-0.1864 -0.1613 -0.1483 0.09278 -0.3151 0.02871

-0.04398 -0.04798 0.01561 -0.04506 -0.1768 -0.03803

LAG07 LAG08 LAG09

0.008986 -0.02272 -0.04262 0.01081 0.2493 0.3194

-0.04619 -0.1493 -0.09121 0.06298 0.1083 0.08513

LAG10 LAG11 LAG12

0.4103 0.04377 0.01628 -0.1909 -0.01679 0.005056

0.1636 -0.1654 0.1557 0.1854 -0.09051 0.07984

ACF INDICATORS: SIGNIFICANCE = 0.95

(using Bartlett's large sample standard errors)

LAG01 LAG02 LAG03 LAG04 LAG05 LAG06

-+-+ -+-+ -+-+ -+-+ -+-+ -+-+

-+-+ -+-+ -+-+ -+-+ -+-+ -+-+

LAG07 LAG08 LAG09 LAG10 LAG11 LAG12

-+-+ -+-+ -+-+ -+-+ -+-+ -+-+

-+-+ -+-+ -+-+ -+-+ -+-+ -+-+

Multivariate Goodness of Fit Test

Lag Qs P-Value

3 9.5468 0.0488

4 12.4737 0.1313

5 17.3960 0.1353

6 26.3349 0.0495

7 28.0138 0.1091

8 29.4429 0.2039

9 38.2221 0.0943

10 55.2182 0.0066

11 64.9744 0.0022

12 66.9787 0.0048Forecasting

We will produce forecasts from our model, using vmforecastmt. It takes five inputs:

- A varmamtControl structure which, as we saw above, contains the AR order and other model settings.

- A varmamtOut structure, possibly returned by varmaxmt, which will contain the parameter estimates for our VAR model.

- A time series vector from which to produce forecasts. The length of this vector must be (p + 1), where p is the specified order of the AR process. However, vmforecast will read from the end of the vector. This allows you to pass in the entire time series if you want forecasts from the end of your data.

- A vector or matrix, containing any exogenous variables in the model over the forecast horizon.

- A scalar, the number of periods to forecast.

vmforecastmt returns a matrix in which the first column contains the forecast observation number (from 1 to the number of forecast periods), the remaining columns contain the forecast for each of the endogenous variables. Continuing on with our example, we will produce a 10 period forecast:

//Produce 10 period forecast

//Since we have no exogenous variables,

//we pass a scalar zero for the 4th input

f = vmforecastmt(vctl, vout, y, 0, 10);The forecast matrix, f should look similar to this:

1 0.437 0.222

2 0.0291 -0.286

3 0.151 -0.338

4 -0.0829 -0.242

5 -0.169 -0.213

6 -0.0461 -0.0513

7 -0.0927 0.0731

8 -0.0407 0.0669

9 0.0481 0.102

10 0.00988 0.0714After calculating our forecast, we can plot the original differenced data and our forecasts together like this:

//Declare 'myPlot' to be a plotControl structure

struct plotControl myPlot;

//Fill 'myPlot' with default values

myPlot = plotGetDefaults("xy");

//Set line colors

plotSetLineColor(&myPlot, "orange"$|"blue");

plotSetTitle(&myPlot, "Differenced data and VAR(2) model forecast", "times", 18);

//Plot differenced 'y' data

plotTS(myPlot, 1850, 1, y);

//Set line style dots for forecast period

plotSetLineStyle(&myPlot, 3);

//Add forecasts to plot

plotAddTS(myPlot, 1910, 1, f[.,2:3]);Which should produce the following graph.

The Command File

Finally we put it all together in the command file below, which will reproduce all output shown above.//Load TSMT library functions

library tsmt;

/*******************************************

** **

** Load and process data **

** **

*******************************************/

//Create file name with full path

fname = getGAUSSHome() $+ "examples/minkmt.asc";

//Load all rows of the second and third columns of

//a space separated file

y = csvReadM(fname, 1, 2, " ");

//Difference the data

y = vmdiffmt(y, 1);

/*******************************************

** **

** Estimate **

** **

*******************************************/

//Declare 'vctl' to be a varmamtControl structure

struct varmamtControl vctl;

//Fill 'vctl' with default values

vctl = varmamtControlCreate();

//Specify a VAR(2) model

vctl.ar = 2;

//Declare 'vout' to be a varmamtOut structure

//to hold the return values from 'vout'

struct varmamtOut vout;

//Estimate the parameters of the VAR(2) model

//and print diagnostic information

vout = varmaxmt(vctl, y);

/*******************************************

** **

** Forecast **

** **

*******************************************/

//Create a 10 period forecast

f = vmforecastmt(vctl, vout, y, 0, 10);

/*******************************************

** **

** Plot differenced data and forecast **

** **

*******************************************/

//Declare 'myPlot' to be a plotControl structure

struct plotControl myPlot;

//Fill 'myPlot' with default values

myPlot = plotGetDefaults("xy");

//Set line colors

plotSetLineColor(&myPlot, "orange"$|"blue");

plotSetTitle(&myPlot, "Differenced data and VAR(2) model forecast", "times", 18);

//Plot differenced 'y' data

plotTS(myPlot, 1850, 1, y);

plotSetLineStyle(&myPlot, 3);

//Add forecasts to plot

plotAddTS(myPlot, 1910, 1, f[.,2:3]);