What is risk parity and budgeting?

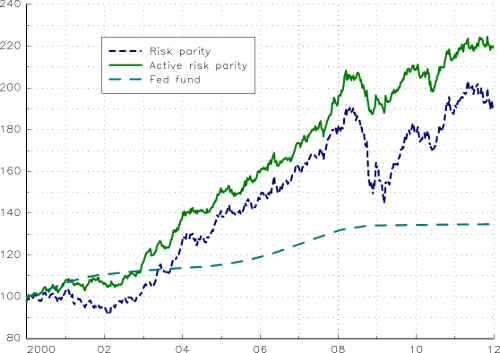

Although portfolio management didn’t change much during the 40 years after the seminal works of Markowitz and Sharpe, the development of risk budgeting techniques marked an important milestone in the deepening of the relationship between risk and asset management. Risk parity then became a popular financial model of investment after the global financial crisis in 2008.

Today, pension funds and institutional investors are using this approach in the development of smart indexing and the redefinition of long-term investment policies. Introduction to Risk Parity and Budgeting provides an up-to-date treatment of this alternative method to Markowitz optimization. It builds financial exposure to equities and commodities, considers credit risk in the management of bond portfolios, and designs long-term investment policy.

Learn the theory and techniques

Dr. Thierry Roncalli's excellent book "Introduction to Risk Parity and Budgeting" details the theory of portfolio optimization and risk parity as well providing application to many different asset classes. Topics include:

- Risk-based equity (also called smart beta).

- Risk budgeting techniques for bond portfolios.

- Alternative investment classes, such as commodities and hedge funds.

- Applications for management of mixed-asset portfolios.

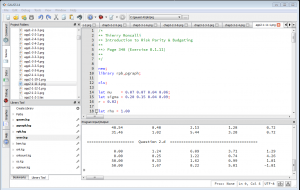

Risk parity and budgeting GAUSS code

GAUSS code is available which reproduces all the tables and figures in the book. It contains over 200 example programs with more than 100 different procedures. The code is modifiable so that you can pass in custom data or modify the procedures to fit your needs.

- GAUSS RPB code for Windows 32-bit gauss-rpb-32

- GAUSS RPB code for Windows 64-bit gauss-rpb-64

Classroom tools

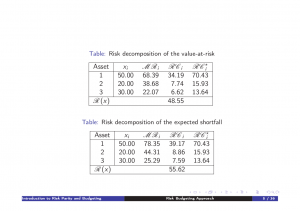

A full set of slides which reproduce all of the tables and figures in the book is available for free to academic course instructors. The slides are available for download in PDF format below, listed by chapter. Powerpoint slides are available by request from the author.

- Modern Portfolio Theory (view slides)

- Risk Budgeting Approach (view slides)

- Risk Based Indexation (view slides)

- Application to Bond Portfolios (view slides)

- Risk Parity Applied to Alternative Investments (view slides)

- Portfolio Allocation with Multi-Asset Classes (view slides)